In today’s ever-evolving, fast-paced world, incorporating sustainability is no longer an option. As per estimates of Swiss Re, by 2050, inaction on climate change will cause the loss of 18% of global GDP. In addition, a recent Deloitte analysis from 2022 estimates that inaction on climate change will cost the world economy $178 trillion over the following five decades. Accelerating to net zero sooner will boost the world economy by an additional $43 trillion by 2070.

To succeed in the long haul, business strategies should take a values-driven approach into consideration. It’s crucial to understand sustainability in business before discussing why it’s critical to effective business strategy.

As per Deloitte Sustainability Report 2022, “57% companies are also providing employee training on climate change/climate action.”

Sustainability in Business

Sustainability in business relates to how businesses impact society or the environment. In order to solve some of the most pressing problems facing the globe, a sustainable business strategy seeks to positively influence any or both of those sectors.

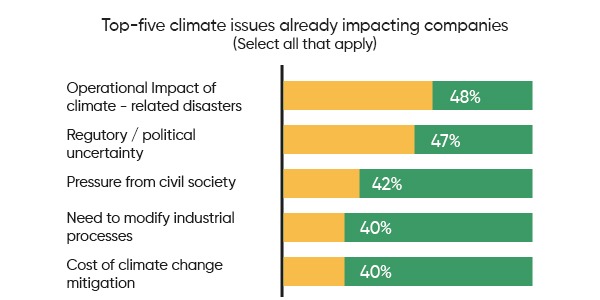

There is a growing understanding that businesses need to operate in a more sustainable way as a result of the increasing environmental and social difficulties we face. Instead of focusing only just on financial concerns when making decisions, a sustainable business also considers social and environmental aspects. This can assist companies in minimizing their adverse effects on the environment and fostering constructive social change.

Reasons To Invest In Sustainability Today…

For start-ups to be successful, funding is not the sole requirement. Putting sustainability first in their business practices is also important. Due to the fact that it enables start-ups to lessen their impact on the environment and improve society, sustainability is crucial.

To begin with, sustainability can aid startups in luring investors. Investors are growing more and more interested in funding start-ups with a sustainable business model that benefits society. Startups may stand out from their rivals and draw in more investors by giving sustainability a top priority in their business operations. Selling “eco-friendly” products and lowering emissions are not the only components of true corporate sustainability. Because they operate with a purpose, sustainable businesses have business models that place equal priority on social and environmental impact as they do on financial profit.

Second, sustainability is crucial for startups since it can help in the development of a solid brand reputation. Startups that are committed to sustainability are viewed favorably by investors. The benefits of doing this include developing a sizable customer base and luring investments and partnerships.

Finally, cost-cutting strategies for sustainability can benefit startups. Start-ups can cut costs on their operations by implementing sustainable practices, such as cutting back on waste and energy use. Starting businesses might benefit from this by turning a profit and luring new investors.

Sustainable Investing – Is It A Real Thing?

Sustainable investing, also known as socially responsible investing (SRI), environmental, social, and governance (ESG) investing, or ESG investing, is an investment strategy that takes into account both financial returns and social and environmental factors in order to promote positive social change.

In sustainable investing, social, environmental, and financial rewards are all given the same weight and invested in progress.

It’s about establishing new, more effective business practises and building the momentum necessary to persuade increasing numbers of people to choose to participate in the inclusive future we’re trying to build. Investors from large institutions to private individuals are pursuing their financial goals in a sustainable way by combining conventional investment strategies with ESG knowledge.

Sigurd’s founding partner has recently entered the ESG space with BlueEarth. With multiple clients comprising MNCs and the government, BlueEarth has been in the forefront to provide solutions for carbon offsets, and sustainability solutions. Through the implementation of various carbon offset mechanisms like CDM, VCS, Gold Standard (GS), GCC, IREC, and others, it aims to restore the Earth to a low-carbon and climate-resilient global economy in the short term and nature-based solutions in the long term. In order to create and provide carbon credits, it has been playing a crucial role in the global carbon market.

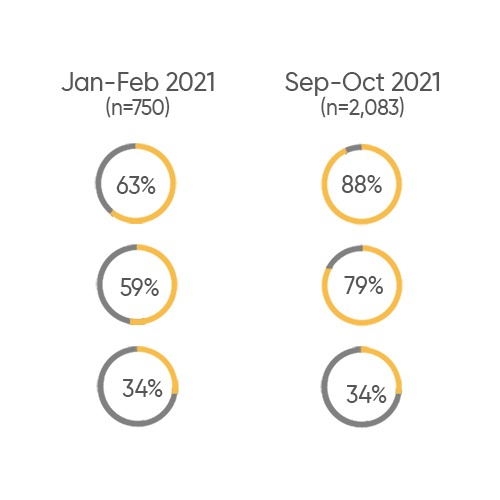

As per WeWork’s 2022 study of 850 companies worldwide, 80% said they plan to increase their investments in sustainability.

The Bottom Line

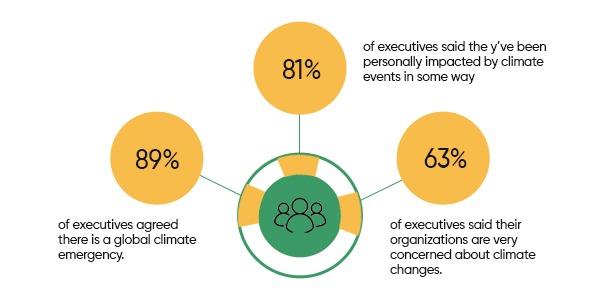

Without a doubt, climate change and global warming are a Universal concern. Everyone is aware of the climate emergency and the urgent need to start making significant measures to minimize their carbon footprint, from international organizations to private and public businesses, from governments to consumers.

As per Forbes, “Although 90% of business leaders think sustainability is important, only 60% of companies have a sustainability strategy”. The numbers suggest that there is a vast scope for young hustlers especially those looking for startup funding—must take sustainability and ESG into account. Sigurd Ventures is dedicated to supporting start-ups that are creating world-class solutions for society and are changing the dynamics.