In today’s ever-evolving business landscape, startups are not just agents of innovation; they are also crucial contributors to a sustainable future. Sigurd is keenly aware of the growing ESG space in the startup ecosystem. This blog delves into the imperative for eco-friendly practices, renewable energy solutions, and environmentally conscious product development. We will also explore why sustainability is a magnet for investors and share a case study on Sigurd’s investment in Accacia and Blue Earth, the startups on a mission to rehabilitate the Earth to a low-carbon, climate-resilient global economy in the short term.

The Surge in Sustainability

The call for increased sustainability holds real weight, fueled by the escalating climate vagaries and environmental concerns. Since 2019, there has been a remarkable five-fold growth in sustainable practices across multiple industries, geographies, and organizations. Stakeholders, partners, brands, and customers alike are now looking for demonstrable actions toward Environmental, Social, and Governance (ESG) goals.

Exploring the Construction Industry: A Closer Look

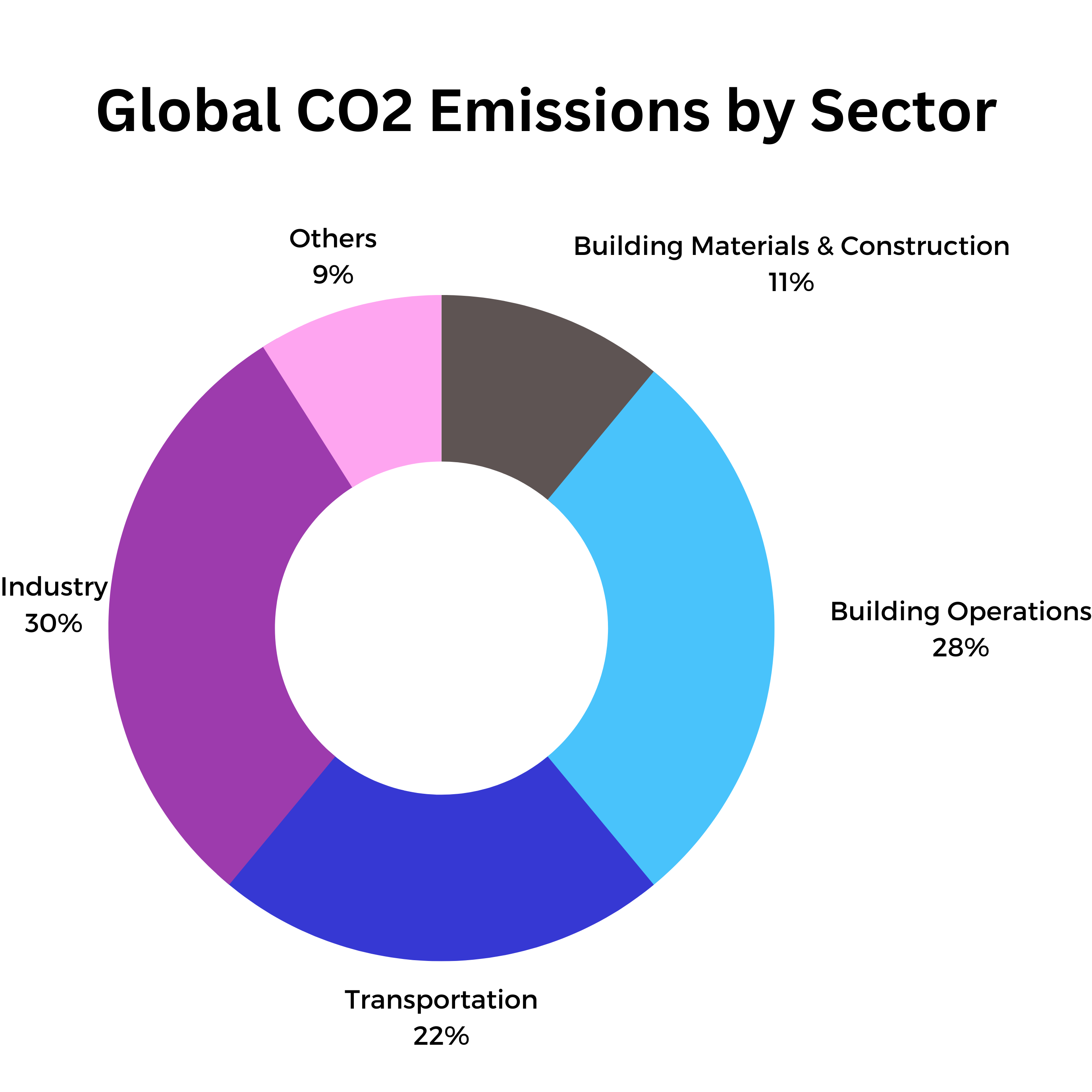

The construction sector is responsible for nearly 40% of the world’s CO2 emissions, with much of this environmental impact driven by the ongoing process of urbanization. A significant portion of these emissions can be attributed to the reliance on fossil fuels to power construction activities, resulting in the release of approximately 500 million tonnes of CO2 annually. Moreover, the noise and exhaust emissions stemming from the use of fossil fuels pose health risks to workers and contribute to local air pollution.

However, the construction industry is swiftly undergoing a transformation. Accacia, backed by Sigurd, offers a groundbreaking solution for large property owners seeking to monitor their carbon impact in real-time. Through seamless integration with ERPs and property management systems such as Yardi, Accacia has already been successfully implemented across more than 20 million square feet of real estate in Asia. The platform’s reach is expanding rapidly, with plans to cover Southeast Asia, the Middle East, and North America, including the United States and Canada.

Renewable Energy Solutions

The energy sector has witnessed a seismic shift with sustainable startups leading the way. From harnessing solar and wind energy to developing cutting-edge battery technologies, these startups are revolutionizing the industry. Their innovative solutions not only reduce carbon emissions but also offer a glimpse into a cleaner, greener energy future.

Environmentally Conscious Product Development

Sustainability extends to the very heart of a startup – its products. Environmentally conscious product development is a driving force in the startup ecosystem. Startups are crafting products that are both ethical and fashionable, from biodegradable packaging to eco-friendly fashion lines. These products not only cater to the eco-conscious consumer but also provide a competitive edge in the market.

Why Sustainability Will Become 61 Billion Industry By 2030?

Sustainability is not just a feel-good factor; it’s a compelling proposition for investors. As per the study by Fortune Business Insights, the anticipated expansion of the global green technology and sustainability market is forecasted to increase from $16.50 billion in 2023 to $61.92 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 20.8% throughout the forecast period. Here’s why:

- Future-Proofing Investments: Investors recognize that startups prioritizing sustainability are better equipped to adapt to evolving market dynamics and changing consumer preferences. Sustainability is a key driver of long-term business resilience.

- Market Potential: Sustainable startups tap into a rapidly growing market of eco-conscious consumers. These consumers are not only willing to pay a premium for sustainable products and services but also represent a significant portion of the market.

- Risk Mitigation: Sustainable startups tend to exhibit greater resilience in the face of environmental, social, and governance (ESG) risks. Investors appreciate the reduced exposure to risks associated with climate change, environmental regulations, and shifting societal values.

Sigurd’s Investment in Blue Earth: A Case Study

Sigurd’s commitment to sustainability goes beyond words – it’s backed by action. One shining example is our investment in Blue Earth, a startup with a bold objective. Blue Earth is dedicated to rehabilitating the Earth into a low-carbon, climate-resilient global economy in the short term.

Blue Earth actively participates in the global carbon market, creating and providing carbon credits to multinational corporations. These credits allow these corporations to offset their carbon emissions, thus taking tangible steps towards carbon neutrality. To date, millions of credits have been produced, making a significant dent in the fight against climate change.

Predicting Future Trends

The future of sustainability in startups is promising, with several noteworthy trends on the horizon. According to verified sources:

- Green Tech Dominance: Green tech startups are expected to dominate the sustainable startup landscape, with a projected five-year growth rate surpassing 22%.

- Increased Investment: Sustainable startups are predicted to attract more investment, with an estimated 75% increase in funding over the next three years.

- Regulatory Support: Governments worldwide are likely to introduce more policies and incentives that favor sustainable business practices, creating a conducive environment for startups.

Sustainability in startups is no longer a choice; it’s a necessity. It’s about striking a balance between profit and the planet, and at Sigurd, we are proud to support startups that embody this ethos. Together, we can build a more sustainable and prosperous future, where innovation and responsibility go hand in hand.