The founder-focused firm, Sigurd is making a series of seed investments in the ESG space. Betting its way into startups Blue Earth and Accacia, Sigurd looks for ingenious ways to organically expand its business towards making a difference.

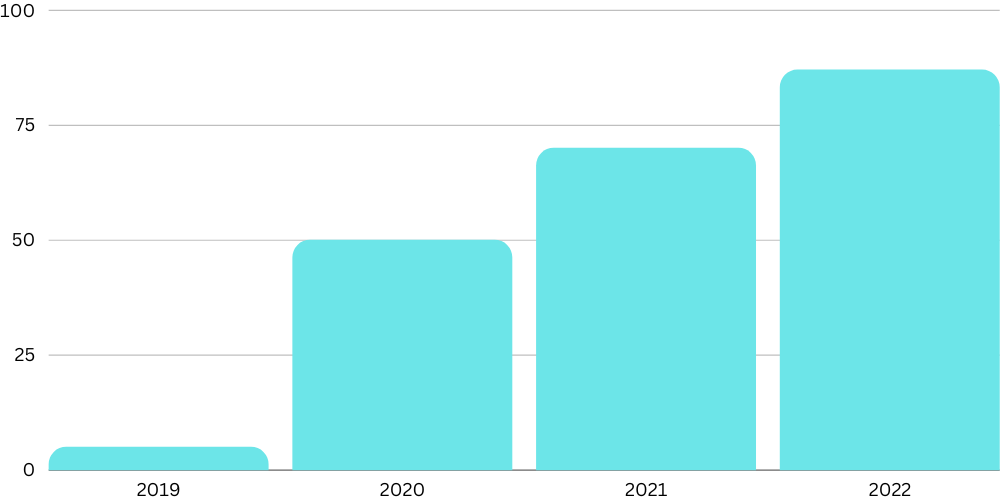

The call for increased sustainability holds real weight owing to the adverse climate vagaries. There has been a five-fold growth across multiple industries, geographies, and organizations since 2019. Stakeholders, partners, brands, and customers are looking for demonstrable actions toward ESG (environmental, social, and governance).

ESG penetration has remained elusive for the past 5-6 years, but it is now finally witnessing the inflection point here with widespread adoption. There has been a growing trend of investors focusing on ESG factors as part of their investment strategies. Even while the rate of new investments has been falling lately, the inflows into ESG are on the rise. The industry witnessed a rise from $5 billion in 2018 to more than $50 billion in 2020—and then to nearly $70 billion in 2021. The numbers rose to $87 billion of net new money in the first quarter of 2022.

Startups have also caught up on the trend- 68% have started applying ESG policies in their company structures catching up on the trend.

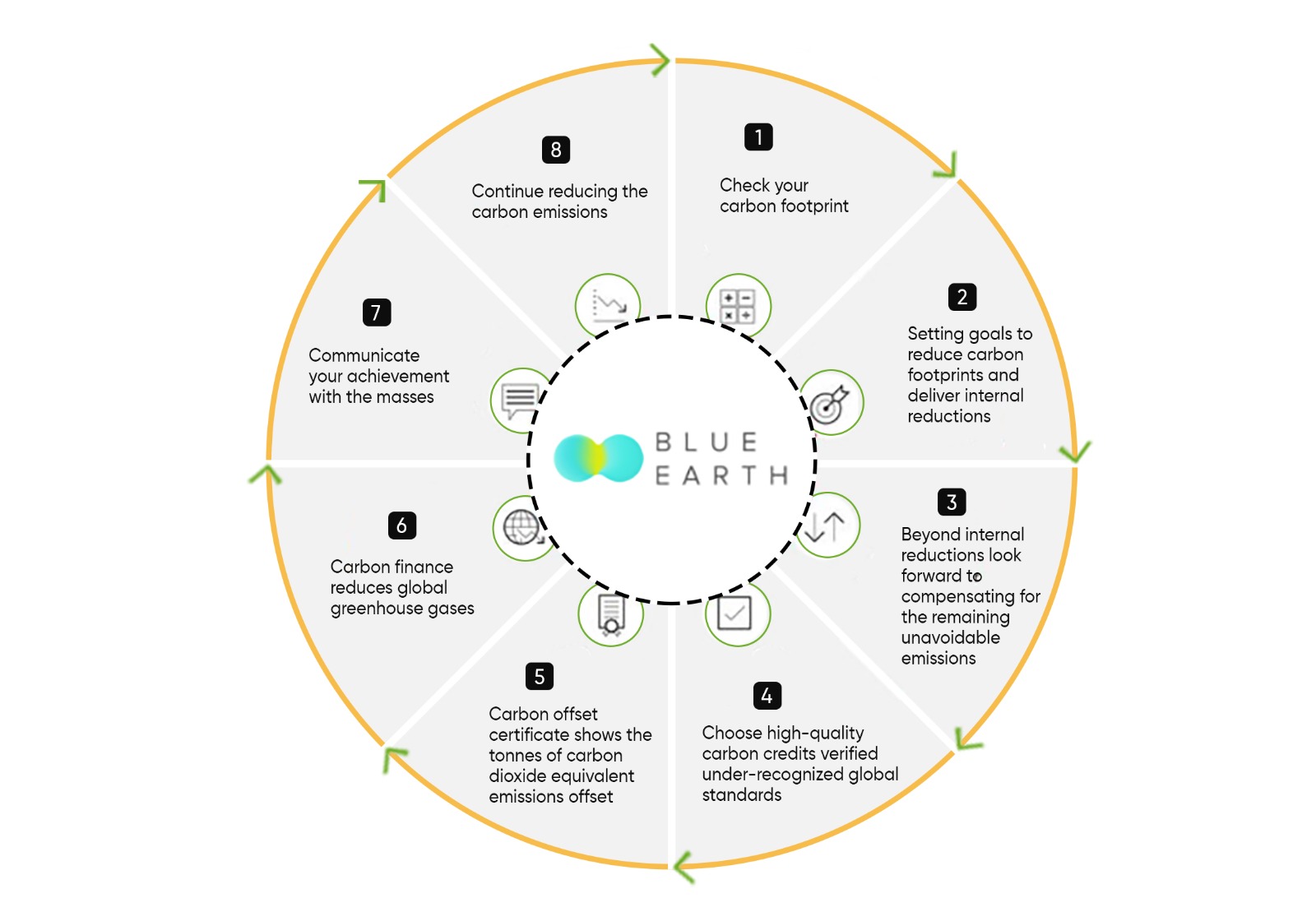

Sigurd has been exploring investment opportunities in a myriad of startups in recent months and has been looking forward to partnering with startups creating sustained outcomes that drive value and fuel growth, whilst strengthening the environment and societies at large. Hence, Sigurd partnered with Blue Earth established with the objective to rehabilitate the Earth to low carbon and a climate-resilient global economy in a short term. In order to create and provide carbon credits, it has been actively playing a crucial role in the global carbon market. Millions of credits have been produced for multinational corporations to offset their carbon emissions.

There has been an increasing demand for investments that align with their values and positively impact society and the environment. The financial services sector has become more engaged with environmental, social, and governance (ESG) matters in recent years, largely due to the surge of regulatory change and growing investor awareness of the impact of climate change and sustainability on their investments. This has led to the development of a wide range of ESG-focused investment funds.

Sigurd emphasizes and recognizes the importance of ESG factors in evaluating the long-term sustainability and profitability of startups. Exploring the ESG space, Sigurd collaborated with Accacia.

Accacia is an AI-enabled SaaS solution designed exclusively for Real Estate and Infrastructure space. The one-of-its-kind AI-enabled platform assists in tracking, measuring, and managing the climate risks due to emissions that form 40% of global emissions. The sector lacks robust tools to measure climate risks and define decarbonization strategies. The Founder and Chief Executive Officer at Accacia, Annu Talreja said, “We are working with large asset managers, developers, and real estate operators to help them with tools they need to define and monitor their path to net zero.”

While the platform’s AI-enabled recommendation engine recommends decarbonization methods at the asset and portfolio levels, customers can monitor and benchmark the transitional and environmental risks on their portfolios, which is one of its own kind.

The trend towards ESG investing is likely to continue as Sigurd seeks to align its investments with its values and support startups that are committed to sustainable and responsible practices.